Steps to Take After Losing a Loved One

Losing a loved one can be very difficult. It is hard to know what needs to be done and what should be done to take care of your loved one’s business and assets. Below is a list of steps you should take upon the death of your loved one:

- Consider advising any surviving family members, friends, and business associates.

- Notify a funeral director and clergy, and make an appointment to discuss funeral arrangements. Make sure to request several copies of the decedent’s death certificate. You will need this document to inform employers, life insurance companies, and/or your attorney for legal procedures.

- Locate the decedent’s important papers. These documents might include the decedent’s will, trust documents, insurance policies, financing documents, account statements, bills/invoices, etc.

- Collect decedent’s mail to look for accounts and bills that need to be settled. The mail can often be a great place to find accounts that the decedent did not tell friends and family about.

- Secure decedent’s phone, computer, and other electronic devices. If you can access decedent’s online accounts, review each account and make note of important emails and accounts you may need to access later.

- Contact an attorney who will help you with the decedent’s affairs. This meeting is important to review documents and understand what the next steps to finalize the decedent’s estate. The attorney will also determine the extent to which it is necessary or advisable to open a probate estate.

- Call the decedent’s employee benefits office with the following information: name, Social Security number, date of death; whether the death was due to accident or illness; and your name and address.

- If decedent was eligible for Medicare, notify the local program office and provide the same information as in the step above.

- Notify life, accident or disability insurers of decedent’s death or disability. Give the same information as in Step #7, and ask what further information is needed to begin processing your claim, if available. Ask which payment option decedent had elected, and select another option if you would so prefer.

- Notify the decedent’s Social Security office of the death. Claims may be expedited if a surviving family member goes in person to the nearest office to investigate making a claim for survivor’s benefits.

- If decedent was ever in the military service, notify the Veterans’ Administration. Surviving relatives may be eligible for death or disability benefits.

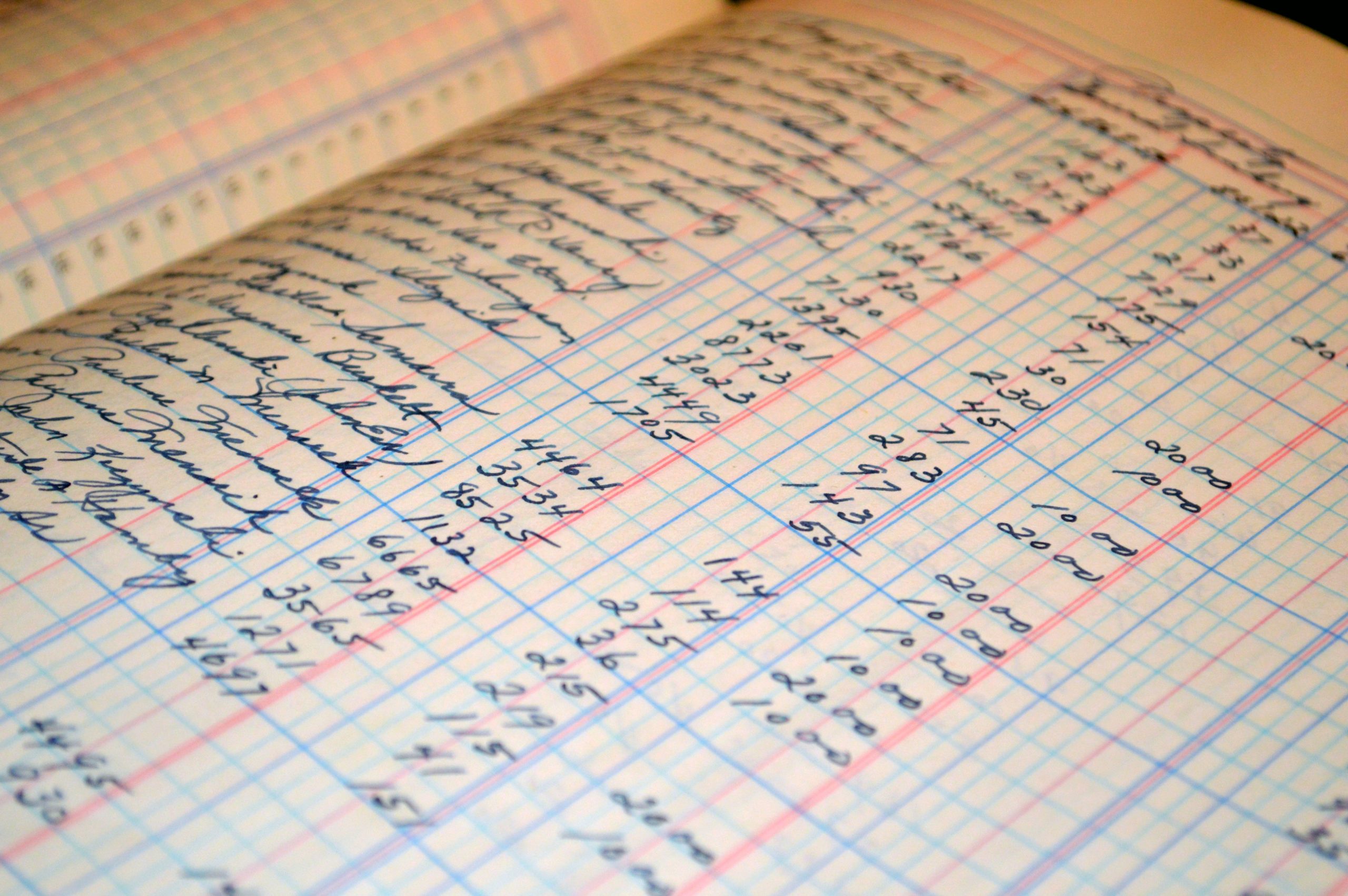

- Record in a small ledger all of the money you or the immediate family spends. These figures may be needed for tax returns and reimbursement.

- Make sure not to change the title to any assets! This can create unnecessary problems for you if it is not done correctly. Please speak to an attorney before starting this process.